Make an impact today.

Courage for Katie, Inc is exempt from federal income tax under Internal Revenue Code (IRC) Section 501(c)(3). Donors can deduct contributions they make to Courage for Katie, Inc under IRC Section 170. We are also qualified to receive tax deductible bequests, devises, transfers, or gifts under Section 2055, 2106, or 2522. Please defer to your tax professional for additional help and guidance in preparing your taxes.

Mission Statement:

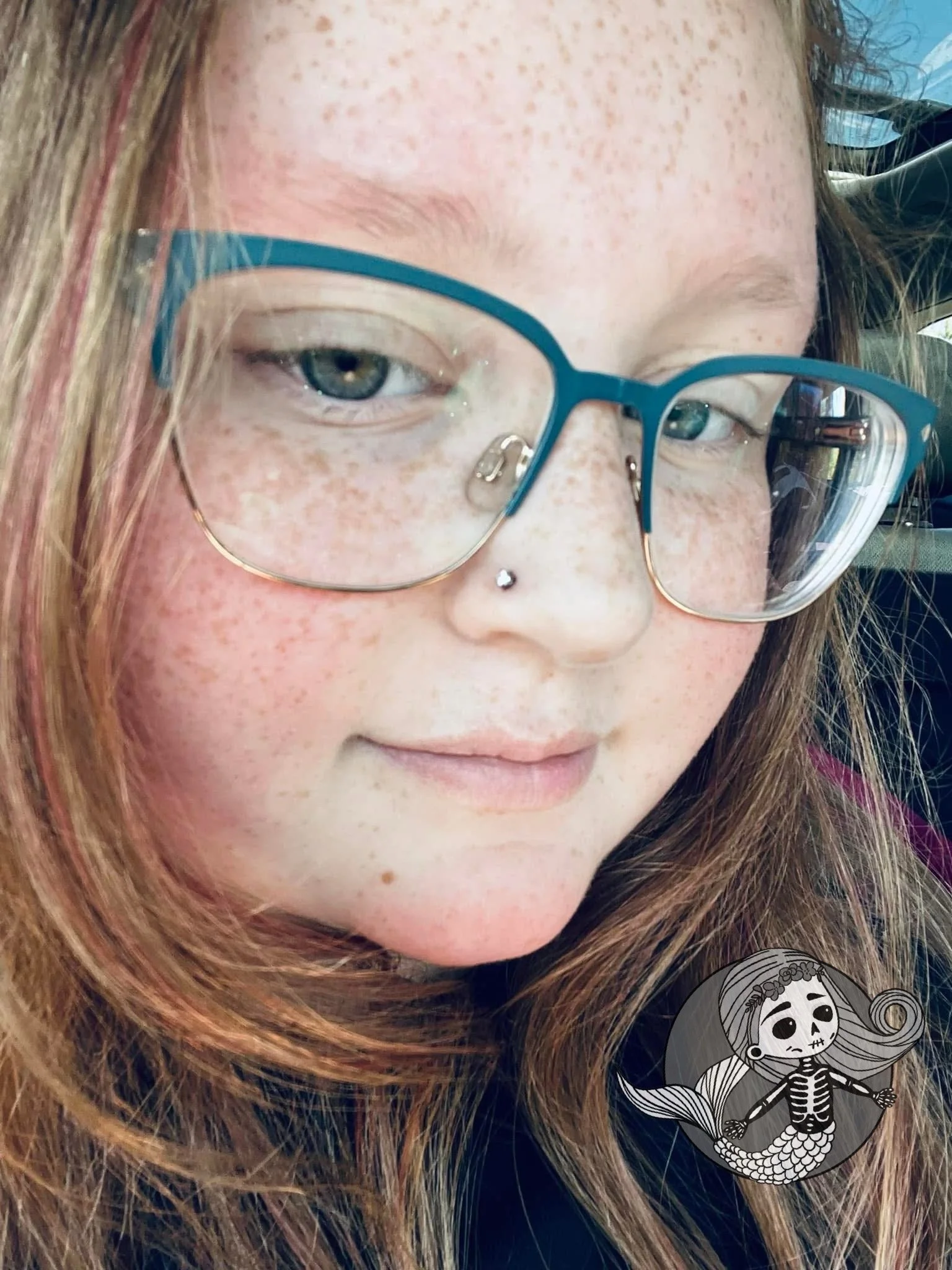

Courage for Katie provides non-medical support to children and families impacted by cancer.

Vision Statement:

Our vision is a world where no child or family affected by cancer feels isolated or unsupported. Through emotional, financial, and practical assistance, we seek to foster community, alleviate burdens, and cultivate courage when all hope feels lost.

Programmatic Goals

Provide financial assistance to families for daily needs during treatment.

Offer emotional support such as peer groups and respite care to reduce the psychological toll of cancer.

Facilitate community engagement by connecting families with local resources, volunteers, and social support networks.

Deliver practical assistance such as meal services, household chores, and transportation to treatment facilities, as well as comfort items for children through programs like “Katie’s Cart”.

Foster a sense of empowerment by helping families develop coping strategies and connect with others facing similar challenges.

Corporate Sponsorship + Partnership

Is your business interested in a sponsorship and/or ongoing partnership? We’d love to connect! Fill out our contact form or email us at hello@courageforkatie.org and a member of our team will get back to you as quickly as possible.